Mortgage Rates

Navigating the world of real estate can be daunting, especially when it comes to understanding mortgage rates and how they affect buyers and investors. In recent months, mortgage rates have been a hot topic, fluctuating in response to economic changes and market conditions. So, what exactly are mortgage rates doing these days?

Currently, mortgage rates are experiencing some volatility, with slight increases and decreases depending on various economic factors. While this might seem unsettling for potential buyers, it actually presents a unique opportunity. Historically, when mortgage rates drop, home prices tend to rise due to increased demand. Therefore, locking in a rate now could be advantageous if you're considering purchasing property.

For buyers, securing a mortgage at today's rates might mean paying slightly more in interest than if they waited for a potential drop. However, this strategy could save money in the long run by avoiding higher home prices that typically accompany lower rates. Additionally, current rates are still relatively low compared to historical averages, making it an opportune time to enter the market.

Investors should also pay close attention to mortgage rate trends. Real estate investments often require significant capital outlay and financing through mortgages. By understanding current rate movements and predicting future shifts, investors can make more informed decisions about when to buy properties or refinance existing loans.

It's also worth noting that while waiting for lower rates might seem like a wise strategy, timing the market is notoriously difficult. Economic conditions can change rapidly, influenced by factors such as inflation, employment rates, and global events. Therefore, making a decision based on current rates rather than speculative future changes is often more practical.

In conclusion, while mortgage rates are fluctuating these days, it's still a good time to buy property. Taking advantage of current rates could potentially save you money if prices increase when rates drop again. Buyers and investors alike should consider their financial situation and long-term goals when deciding whether to enter the market now or wait for potential rate changes.

Categories

- All Blogs (23)

- best places to live in Utah, Utah real estate, Utah neighborhoods (9)

- housing market (11)

- investing (3)

- life (2)

- market forecast (10)

- move (2)

- moving (2)

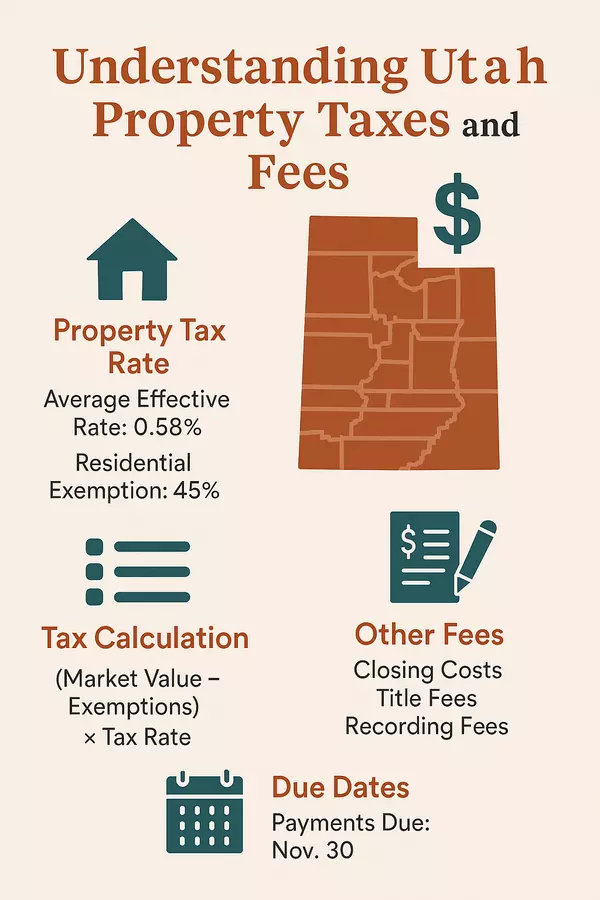

- property taxes (5)

- pros and cons (7)

- real estate (11)

- real estate info (7)

- real estate investing (3)

- real estate utah (12)

- salt lake (8)

- taxes (4)

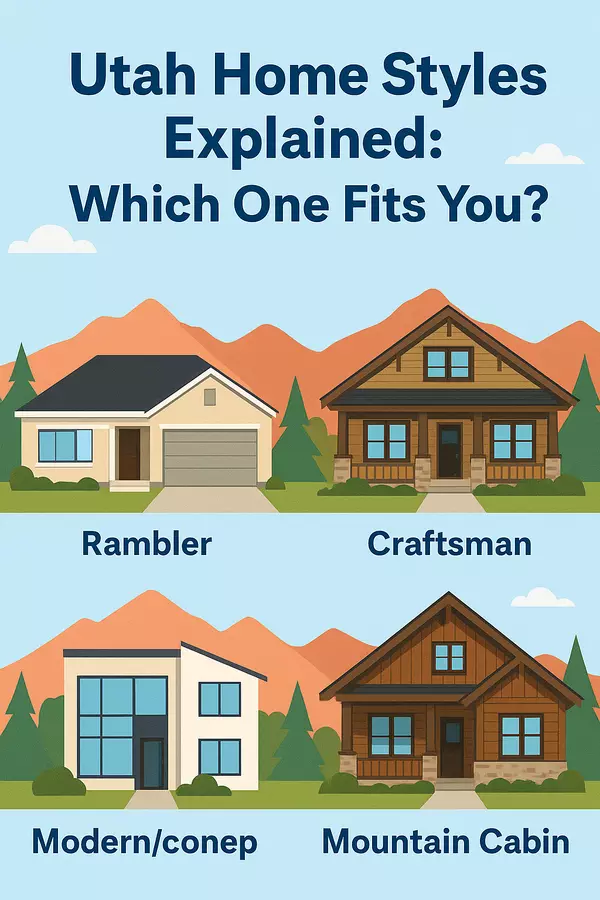

- utah home styles (1)

- utah homes (1)

- utah living (6)

- utah real estate (10)

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "

2180 S 1300 E Suite 140, Salt Lake City, UT 84106, Holladay, UT, 84106, USA