Understanding Utah Property Taxes and Fees: What Homeowners Need to Know in 2025

🧾 Understanding Utah Property Taxes and Fees: What Homeowners Need to Know in 2025

If you’re planning to buy or own real estate in the Beehive State, it’s crucial to understand how Utah property taxes and related fees work. Whether you’re a first-time homebuyer or a seasoned investor, staying informed about taxes, assessments, and closing costs can help you budget more accurately and avoid surprises at the closing table.

Here’s a full breakdown of Utah’s property tax system and real estate-related fees in 2025.

📊 How Property Taxes Work in Utah

Utah uses a "fair market value" system, meaning your property is taxed based on its appraised value, which county assessors update annually.

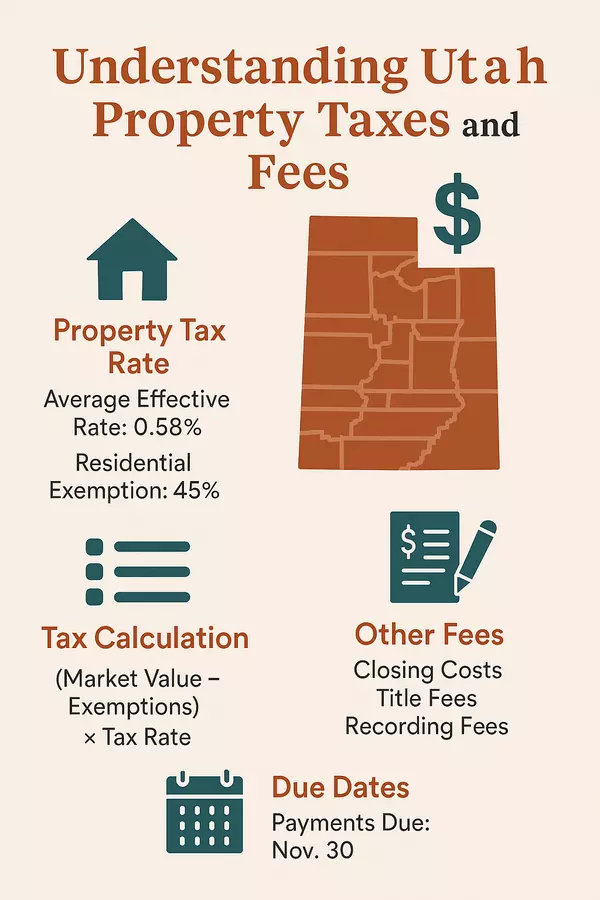

🏠 Utah Property Tax Rate (2025)

-

Statewide average effective rate: ~0.58% (lower than the national average of ~0.99%)

-

Residential exemption: 45% off taxable value for primary residences

-

Example:

-

Home value: $500,000

-

Taxable value after exemption: $275,000

-

Estimated annual tax: ~$1,595

-

📍 Rates Vary by County

| County | Effective Rate |

|---|---|

| Salt Lake County | ~0.66% |

| Utah County | ~0.53% |

| Weber County | ~0.74% |

| Washington County | ~0.60% |

| Cache County | ~0.62% |

Each county may have additional levies for schools, libraries, and special improvement districts.

🏢 Property Types and Exemptions

Utah provides a generous residential exemption for owner-occupied homes:

-

45% of the home's market value is exempt from property taxes.

-

This does not apply to rental or secondary properties.

Veterans, blind individuals, and low-income seniors may also qualify for additional exemptions or abatements.

💸 Other Real Estate Fees in Utah

In addition to annual property taxes, there are transaction-related costs when buying or selling property.

🧾 Typical Closing Costs in Utah (Buyer Side)

| Fee Type | Estimated Range |

|---|---|

| Loan origination | 0.5%–1% of loan amount |

| Title insurance (owner's) | ~$1,000 on $400K home |

| Appraisal fee | $500–$700 |

| Credit report | $30–$50 |

| Escrow/settlement | $300–$800 |

| Recording fees | $40–$75 |

💡 Buyers typically pay between 2%–5% of the home’s value in closing costs.

🏷 Seller Fees

-

Real estate commission: 5%–6% (split between agents)

-

Transfer tax: None in Utah!

-

Title fees: May vary by title company or contract

🧮 How to Estimate Your Property Taxes

Most counties provide an online property tax calculator through their assessor or treasurer websites. Or, use this simple formula:

Example for a $450,000 primary residence in Utah County:

-

Taxable value: $450,000 – 45% exemption = $247,500

-

Rate: ~0.53%

-

Estimated tax: $247,500 × 0.0053 = $1,311.75/year

📅 When Are Property Taxes Due in Utah?

-

Annual billing by each county (no monthly payments unless escrowed with mortgage)

-

Due Dates:

-

November 30: Full payment due

-

Late payments may result in interest and liens

-

✅ Final Thoughts: What This Means for You

Utah's low effective tax rate and residential exemption make it one of the more affordable states in terms of property taxation. Still, homeowners should budget for closing costs, escrow reserves, and annual county bills.

Being aware of exemptions, due dates, and variable county rates will help you plan smarter and avoid any last-minute headaches.

📞 Need Help Estimating Your Property Taxes?

We help buyers navigate Utah’s real estate landscape—including property tax estimates, closing costs, and escrow planning.

🔍 [Start your home search] or reach out for a personalized cost breakdown.

Categories

- All Blogs (23)

- best places to live in Utah, Utah real estate, Utah neighborhoods (9)

- housing market (11)

- investing (3)

- life (2)

- market forecast (10)

- move (2)

- moving (2)

- property taxes (5)

- pros and cons (7)

- real estate (11)

- real estate info (7)

- real estate investing (3)

- real estate utah (12)

- salt lake (8)

- taxes (4)

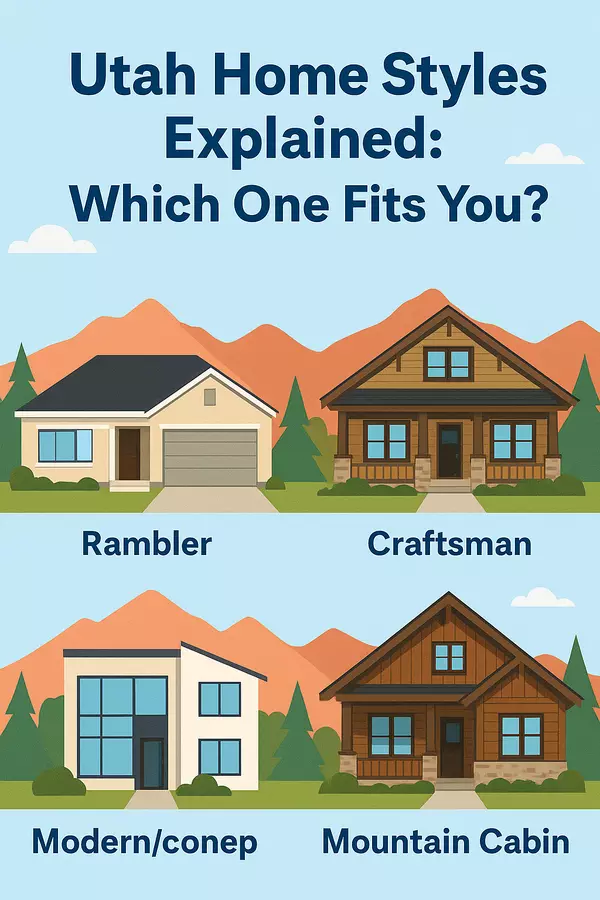

- utah home styles (1)

- utah homes (1)

- utah living (6)

- utah real estate (10)

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "

2180 S 1300 E Suite 140, Salt Lake City, UT 84106, Holladay, UT, 84106, USA